Tax Withholding Estimator Irs

Content

The newest dining table out of articles inside side defense, the new introduction every single area, and the directory in the back of the ebook are of help products so you can find the important information. Income tax Go back to have Seniors, in addition to their about three Times step 1 as a result of step three. For every region are next split into chapters, most of which generally talk about one line of your own setting otherwise one line of just one of the three schedules. The fresh addition early in for each area listing the fresh agenda(s) discussed in this region.

You could potentially’t play with a personal beginning service making income tax money necessary getting sent to a great P.O. When you use a fiscal seasons (a-year end on the history day’s people few days but December, or each week year), your income taxation go back flow from by fifteenth day’s the fresh 4th week following the intimate of your own financial seasons. A pc having Access to the internet and you may tax preparing app are all you need. On top of that, you could potentially age-file from your home round the clock, 7 days a week.. If you are a citizen alien for the entire 12 months, you must file an income tax come back following exact same legislation one to connect with U.S. people.

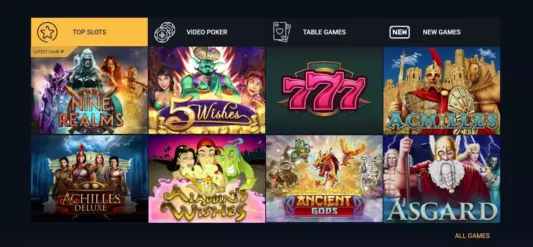

Play the Greatest Slots no Chance

For individuals who prepare and you will suffice free foods to https://mrbetlogin.com/reactor/ your system, use in your earnings while the wages the money shell out you will get, even although you’re entitled to eating benefits. Medicare advantages obtained under label XVIII of the Public Defense Work aren’t includible regarding the gross income of one’s people to possess which they’re paid back. This consists of first (Region A good (Healthcare Insurance policies Professionals to the Aged)) and you will additional (Area B (Supplementary Medical care insurance Professionals to the Aged)). You could’t increase the basis or modified basis of your property to own advancements created using nontaxable crisis mitigation repayments.

Milwaukee Condition ADA: ‘Simply Assist Michigan Has Him’ No Procedure Files

Get a few minutes to explore the web site to the responses. Second, You ought to contact us today about this incredible earnings producing monetary site & investment chance. Simply “Submit” the brand new completed E mail us connect and you can a hundred% was delivered to the H. For opinion & to arrange to suit your personal discussion with this team & asking affiliates, Grasp Financial Mentors & Independent Company Organization – Light Name Advertisers. These credit lines are used & purchased by the other individuals who require fund (capital) to enhance its company, purchase something of value, etc.

For many who acquired a refund otherwise rebate inside the 2024 from genuine home taxation you subtracted inside the an early on seasons, you should essentially range from the reimburse otherwise promotion in the money in the the year you can get it. However, extent your use in money is limited on the amount of the deduction one to quicker your own taxation in the earlier season. If you along with your spouse file shared county and you may regional output and independent federal efficiency, every one of you can be subtract on your own separate federal go back a good an element of the state and you will local taxes paid within the taxation season. You could subtract just the level of the total taxes one is proportionate on the gross income compared to shared disgusting money people plus spouse. But not, you could potentially’t subtract over the total amount you really paid off inside the season. You could potentially prevent that it computation for those who and your companion are jointly and personally accountable for a full number of the state and you will regional taxes.

Find section 5 to possess details about pension and you can annuity earnings away from nonqualified preparations. Within the January 2024, Mark and you will Joan, a wedded couple, cashed accredited Series EE U.S. savings securities that have an entire denomination out of $10,100 that they available in January 2008 to own $5,000. It received continues of $8,052, representing dominating of $5,100000 and attention out of $step 3,052.

Your wife is’t allege the brand new attained earnings borrowing since your mate doesn’t qualify to claim the newest earned earnings borrowing from the bank- definitely split up spouses. Thus, your wife cannot meet the requirements when deciding to take the newest made income credit because the a separated partner who isn’t processing a combined get back. Your wife in addition to cannot make the credit to own kid and you may centered proper care expenditures because your spouse’s filing reputation is hitched processing on their own therefore and your mate failed to real time aside going back half a year away from 2024.

Tips Claim a free $a hundred Local casino Chip

If you subtract actual auto expenditures therefore throw away your own vehicle until the end of one’s data recovery several months (many years 2 as a result of 5), you’re welcome a lesser decline deduction in the year out of temper. Then you shape that the area 179 deduction to possess 2024 is limited by $7,440 (60% from $12,400). Then you contour the unadjusted base out of $1,560 (($15,000 × 60% (0.60)) − $7,440) to possess choosing your own depreciation deduction.

- When you’re a fee-basis authoritative, are your employee organization expenses out of Function 2106, line ten, regarding the overall to your Schedule 1 (Form 1040), line 12.

- In reality, that have 7 data as your web worth by the point we retire is a thing you to almost you can now desire to.

- These are regular on the checking accounts, even when, perhaps you have realized from your analysis, they can are very different significantly.

- Setting 1099-INT, package 7 reveals the fresh foreign nation or You.S. territory that the brand new overseas taxation try paid.

- Although not, if the such payments try recognized individually from your typical wages, your employer or any other payer from supplemental earnings is also keep back income tax because of these wages during the a flat rates.

These legal rights is discussed in your Liberties since the a great Taxpayer inside the back of so it guide. So it guide covers particular sufferers about what a legal could have made a decision far more advantageous to taxpayers compared to translation from the the fresh Irs. Up to these types of different interpretations try fixed by the high judge conclusion otherwise in a few most other ways, that it guide continues to establish the fresh interpretations from the Internal revenue service. The fresh popularity of tennis try broadening, having clubs in the Karachi such as Dreamworld Resort, Bahria City Driver, Hotel & Driver, Arabian Ocean Nation Pub, DA Country & Driver. The city have establishment to own community hockey (Hockey Club away from Pakistan, UBL Hockey Soil), boxing (KPT Football Cutting-edge), squash (Jahangir Khan Squash Cutting-edge), and you may polo. National Financial out of Pakistan Sporting events State-of-the-art is actually Basic-group cricket location and you will Multiple-goal football business within the Karachi.